Can dialogue be established between civil society and corporations on social and environmental questions such as climate change? Our study of shareholder engagement at Ford and General Motors suggests that dialogue is possible and socially-conscious shareholders might be able to drive positive change in corporations on climate change.

We also show that overcoming initial adversarial positions take years and, to use the language of Jürgen Habermas, parties need to shift from strategic action. The strategic action is the instrumental pursuit of individual goals, to communicative action: a form of coordinated action where parties achieve a common definition of the situation. Our study shows how these ideas from German philosophy help explain engagement effectiveness, and understand current events in corporate boardrooms.

Dialogue has become central not only for traditional social movements, non-governmental organizations (NGOs), and labor unions, but also for shareholders, who are increasingly active on environmental, social and governance (ESG) issue.

One reason behind this new form of investor activism is the rise of responsible investment; with more than 2000 signatories to the United Nations sponsored Principles for Responsible Investment, and more than $30 trillion in sustainable assets under management.

As stewards of their investment, investors who traditionally were passive and did not interfere with management decisions, especially in the US context, are now raising ESG issues through their voting power. More directly, they do so by opening direct communication channels with board members and top executives.

These practices are referred to as shareholder engagement and include proxy voting, the organization of regular formal meetings with board members and top managers, and of stakeholder roundtables involving multiple companies around specific issues.

As the practice becomes mainstream (even asset managers like Blackrock and Fidelity are now doing it) a debate on engagement effectiveness is brewing. Advocates point to the success of large investors to convince Royal Dutch Shell to set carbon-output targets and commit to halve its “net carbon footprint” by 2050.

Skeptics worry that engagement might be another greenwashing tactic. But even when it works, what makes an engagement effective? Why do some engagement advance while others falter?

This was the question we set out to study as in September 2008 we started interviewing members of the New York-based Interfaith Center for Corporate Responsibility (ICCR), a coalition of 300 faith-based investors, socially responsible investment funds, and public pension funds, that since 1971 has been practicing shareholder engagement. For almost a decade, we interviewed ICCR’s members, executives and staff, some of the corporate executives they were engaging, and participated in many of the bi-annual meetings they organized.

This was a great opportunity to learn about this practice from the people who literally invented it. Paul Neuhaser, for instance, drafted the first ever social resolution presented at General Motors during the anti-apartheid campaign, and was still active when we started our study.

We met and interviewed multiple times religious women such as Barbara Aires and Patricia Daly, who successfully led engagement dialogues for more than three decades, staff members, and former executives such as Laura Berry and Tim Smith. We also had access to their historical archive of 30 years of engagement activity.

As we learned about the engagement process as practiced at ICCR, we started to question the dominant interpretation of this phenomenon suggested by both economist and sociologists: engagement as a form of reputational threat. Social movement theorists, for instance, have convincingly showed that protests and boycotts targeted at corporations work through this mechanism, as corporations care about their reputations.

What we observed instead was that successful engagements unfolded without relying solely on reputational threat, but rather by a process whereby parties transform their relationship from adversarial into collaborative, identify a common ground, and collective experiment solutions to address the issues.

In a recently published article we report our findings from a comparative study of ICCR engagement on climate change with Ford and General Motors between 1997 and 2009. Over a decade of engagement activity, ICCR made effective progress with Ford, which went from supporting a climate change denialism lobby group to developing a comprehensive climate change strategy (including fleet emission targets).

General Motors started from the same position, but despite their persistence, ICCR members were not able to materially change GM’s policies. What explains these different outcomes?

We suggest that in the case of Ford, ICCR members and corporate managers were able to (1) creatively reinterpret their relationship with the corporation, then (2) collectively define a common ground by reframing climate change as “climate risk”, which in turn (3) enabled them to experiment various solutions to the challenge, and collectively deliberate their outcomes.

Of course, we are far from Habermas’s ideal of communicative action, but our findings suggest it might be possible, even in the corporate boardroom, to shift away from strategic action, especially as managers and investors are dealing with issues that require creative collective efforts.

For instance, the reframing of climate change as climate risk, for instance, helped corporate managers at Ford to translate what was perceived initially as a policy issues, and thus to be dealt with by governments, into a business risk one, and thus a priority for executives.

This reframing emerged slowly out of the interactions between ICCR, other key investors group such as CERES, and Ford managers, and was sanctioned in the publication of Ford’s climate risk report, a landmark in the evolution of corporate understanding of climate change. This common ground enabled further cycles of interactions whereby concrete solutions could be explored and discussed. Beyond shareholder engagement, we believe that creating more opportunities for dialogue within and across civil society and corporations, might help the current trends towards polarization and impoverishment of debate around important, complex, and urgent issues, and hopefully help us identify solutions for these challenges.

Read more

Ferraro, Fabrizio and Daniel Beunza. “Creating Common Ground: A Communicative Action Model of Dialogue in Shareholder Engagement” Organization Science 2018.

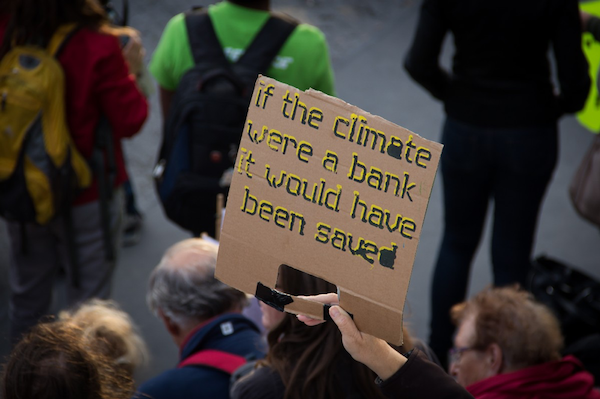

Image: pxhere (Creative Commons CC0)

No Comments