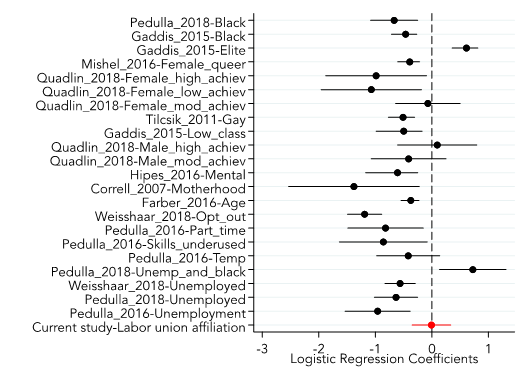

Strikes at Kaiser Permanente, John Deere, and Kellogg’s have brought renewed attention to workers’ clout when they organize unions. Collective bargaining agreements can convert wage gains from a temporarily tight labor market into durable gains for workers. As a result, U.S. employers often pull out all the stops to defeat new union organizing drives. Many employers bet that it’s better to break the law and keep workers from getting a union than to be stuck with collective bargaining for years to come.

Historically, one powerful way that employers have kept unions out is by avoiding hiring union supporters in the first place. If an employer can systematically weed out applications from “bad apples” and pro-union malcontents, then the risk of a successful future organizing drive is mitigated. For example, a case study of hiring in a 1990s foreign auto plant found that managers avoided workers with prior auto experience, because that meant prior employment at the unionized Big Three American automakers. No auto experience, no union problem.

Continue Reading…

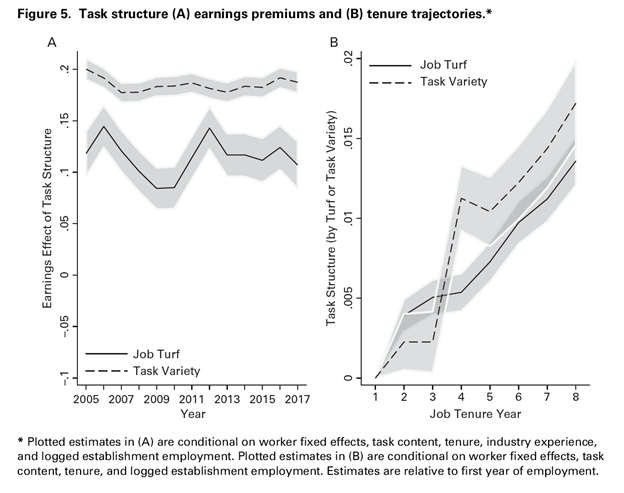

Stagnating wages among U.S. workers since the 1970s is well-documented. Also well-known is the outsized—and still growing—market impact of a small number of giant retailers such as Amazon.com Inc and Walmart Inc. What is less known is whether these two trends are linked.

Stagnating wages among U.S. workers since the 1970s is well-documented. Also well-known is the outsized—and still growing—market impact of a small number of giant retailers such as Amazon.com Inc and Walmart Inc. What is less known is whether these two trends are linked.