Many people have an opinion about the importance of birth order. They might recall that while their parents gave them a curfew, that didn’t apply to their younger brother. Or that their parents idolized the oldest child. The interesting thing is, research suggests that birth order actually does influence the long-term paths that people follow in life.

Previous research has shown that, compared to first-borns, later-born siblings in the same family tend to have lower grades in high school, are less likely to go to university, achieve a lower overall level of education, have less prestigious occupations in adulthood, and also make less money.

Furthermore, it is not just a difference between first-borns and all later-born siblings; the second-born typically does worse than the first-born, the third-born does worse than the second-born, and so on. These patterns are observed amongst children who grew up in the same family, and can be seen across families of all sizes.

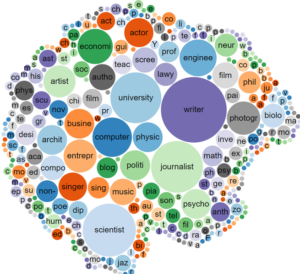

In our study we wanted to extend this research to see whether there are birth order differences in what siblings choose to study if they go to university. College major can matter a lot for long-term outcomes.

Research in the United States and Norway has shown that the difference in long-term earnings between the most lucrative and the least lucrative college major can be as large as the earnings gap between those who go to college and those who do not.

Examining whether there are birth order differences in college major would help us to further understand the effects of birth order on education. Furthermore, birth order differences in college major might explain part of the long-term birth order differences observed in occupational prestige and earnings, given the importance of college major for those outcomes.

It is difficult to overlook the growing number of reports and studies documenting the downward spiral of personal financial wellness within the United States. The

It is difficult to overlook the growing number of reports and studies documenting the downward spiral of personal financial wellness within the United States. The  By the end of this month, the Internal Revenue Service will have

By the end of this month, the Internal Revenue Service will have Compared to other workers, mothers face a number of disadvantages, including lower wages, bias in recruitment and promotion, and a greater risk of joblessness. These disadvantages may be more prevalent in professional jobs where ‘ideal worker’ norms are most salient. Professional employers tend to view mothers as less competent and committed than other workers—a major stigma in careers that require around-the-clock dedication.

Compared to other workers, mothers face a number of disadvantages, including lower wages, bias in recruitment and promotion, and a greater risk of joblessness. These disadvantages may be more prevalent in professional jobs where ‘ideal worker’ norms are most salient. Professional employers tend to view mothers as less competent and committed than other workers—a major stigma in careers that require around-the-clock dedication. Fifty years after the civil rights movement, racial economic inequality remains a major fact of American life. In fact, the gap in family income between blacks and whites has been almost perfectly constant since the 1960s.

Fifty years after the civil rights movement, racial economic inequality remains a major fact of American life. In fact, the gap in family income between blacks and whites has been almost perfectly constant since the 1960s.